AI is hot… and that could constrain its growth

16 December 2025

AI growth will be limited by the ability of data centers to remove heat at GW-scale amid tightening power, water, and supply-chain constraints. Developers must secure facility-level cooling capacity early, while investors should focus on integrated, modular technologies that can be deployed with next-gen AI loads independent of rack-level changes.

There is a bottleneck in cooling

Cooling operations consume 30 to 40 percent of energy usage in data centers(1). Despite being the same physical size, power demands on racks have escalated from 5-10kW to over 350kW per rack due to higher compute density from next-generation chips and architecture(2). As a result, the cooling supply chain struggles to keep pace. High-efficiency cooling equipment often has lead times exceeding 35 weeks(3), and projects are exacerbated by environmental challenges such as water scarcity in warmer regions like Arizona and Texas. This creates a significant bottleneck for expanding data center capacity.

Compute demand increases the challenge

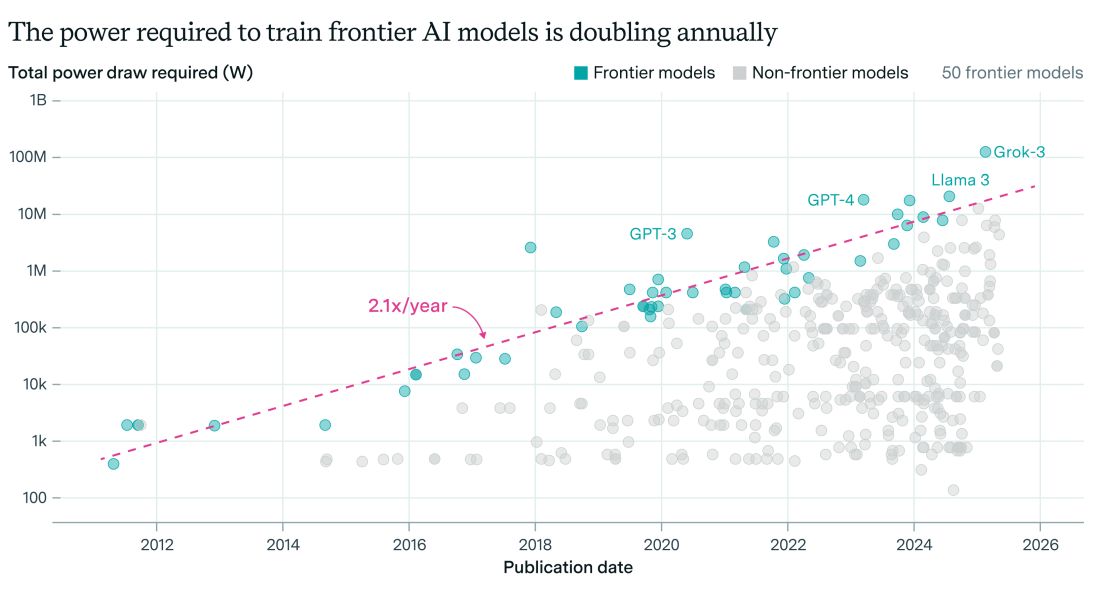

As AI models grow in size, corresponding thermal loads scale exponentially due to three key factors:

- More compute demand – larger AI models require more parameters which translates to more GPUs that are networked together in clusters

- High power density – GPUs are tightly packed on a single rack. Heat output rises non-linearly because cooling efficiency drops as density increases

- Longer training times – bigger models run for weeks or months, creating sustained thermal loads rather than short peaks

Power demand for training the newest, largest models has been doubling annually over the last 15 years; Source: EPRI and Epoch AI

A decade ago, a 30MW data center was considered large; whereas today, “AI factories” are being designed with 1GW+ power requirements. Nearly every watt consumed becomes heat that needs to be cooled. Any inefficiencies related to cooling result in higher energy costs, reduced chip performance, accelerated equipment aging, or worst case, system-level shut down.

Focusing solely on rack-level cooling is not the answer

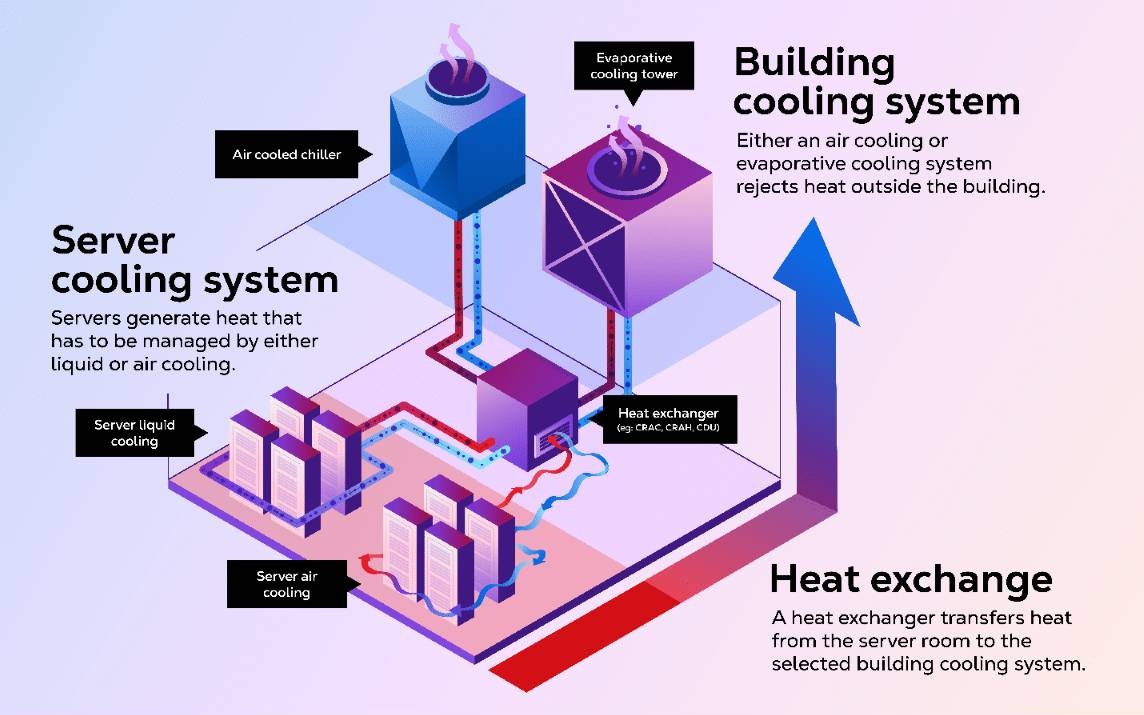

While considerable attention has been directed toward the computing racks themselves and the potential of liquid and immersion cooling systems, ultimately, every unit of heat must be fully removed from the facility.

How AI servers are cooled; Source: CDO Trends and Contrary Research

Imagine a highway that widens near an urban center but narrows as it approaches a single toll booth. Although increased lanes alleviate traffic upstream, delays still occur at the booth. In data centers, the ‘toll booths’ are the computer room air handlers (CRAHs), heat exchangers, and chillers, which are vital for transferring heat outside the building. We think you will continue to see more announcements and activity focused on these facility-level systems from incumbents and innovators alike(4).

Leveraging manufacturing innovations to reduce lead times

Addressing this cooling bottleneck requires more than technology; it necessitates a robust manufacturing strategy. Take, for example, XNRGY, a company within the Climate Investment portfolio that has pioneered a fan-wall air system with adaptive controls designed to optimize airflow in real-time. Coupled with advanced chiller technology, this system maintains efficiency under varying environmental conditions. Its new 330,000 square-foot facility in Mesa, Arizona, enhances production capabilities and compresses lead times, a vital competitive edge in a market rife with delays.

XNRGY’s Mesa 1 facility in Arizona; Source: XNRGY

Climate Investment lens

Data center developers are prioritizing heat rejection capacity as an asset that must be secured early. Hyperscalers and neoclouds are locking in multi-year delivery programs, building monthly manufacturing cadence into service agreements, as well as choosing vendors who can answer the phone at midnight and deliver equipment in months rather than years. Water-free, integrated systems that avoid third-party controls and perform reliably in high-ambient regions reduce commissioning delays, remove millions in integration costs, and let customers scale toward gigawatt-level programs without being trapped by supply chain bottlenecks.

Disciplined capital is drawn to leverage points where physics, reliability, and supply chains intersect. In AI infrastructure, backing platforms that deliver measurable efficiency improvements alongside robust manufacturing capabilities will create lasting customer value and tangible emissions reductions. This alignment is essential for achieving decarbonization goals while facilitating the growth of AI capacity.

1 Zhang et. Al (2021), A survey on data center cooling systems, Journal of Systems Architecture; McKinsey & Co (2023), Investing in the rising data center economy

2 Michael Bommarito (2025), rack density evolution: from 5kw to 350kw per rack

3 JLL (2025), North America Data Center Report, Year-end 2024, pg.22

4 Data Center Dynamics (2025), Schneider Electric and Switch pen $1.9Bn cooling deal

Disclaimer Clause

This publication contains certain forward-looking statements – that is, statements related to future, not past events and circumstances – which may relate to the ambitions, aims, targets, plans and objectives of OGCI Climate Investments LLP or its subsidiaries (“CI”) and/ or its member companies. These use expressions such as “accelerate”, “advance”, “aim”, “ambition”, “commit”, “expect”, “plans”, “strive”, “target” and “will” or similar expressions intended to identify such forward-looking statements. Forward looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will or may occur in the future and are outside of the control of CI and/or its member companies. Actual results or outcomes may differ from those expressed in such statements, depending on a variety of factors. CI does not undertake to publicly update or revise these forward-looking statements, even if experience or future changes make it clear that the projected performance, conditions or events expressed or implied therein will not be realized. © 2025, OGCI Climate Investments LLP. All rights reserved.