Portfolio companies

Climate Investment currently has over 40 innovative companies in its portfolio across energy-intensive sectors: energy systems, buildings, transport and industry, including cement, steel, chemicals, power and agriculture.

Many of these portfolio companies have integrated artificial intelligence (“AI”) within physical technologies to deliver the most efficient and low-emitting solutions. Find out more about them.

Company

Description

Key Data

44.01 converts CO2 into rock within twelve months, capturing it from the air or industrial processes. This technology enables further decarbonization in industries like steel, ammonia, and chemicals.

Venture Capital - UK, Middle East

Year Founded:

2020

CI invested:

2024

Leadership:

Talal Hasan, Founder and CEO

Location:

London, UK and Muscat, Oman

News & Resources

Company

Description

Key Data

75F offers a combined hardware and software solution to manage energy consumption for heating, ventilation, air conditioning (HVAC) systems and lighting in commercial buildings.

Venture Capital - North America, Asia

Year Founded:

2012

CI invested:

2019

Leadership:

Deepinder Singh, Founder and CEO

Location:

US, India and Singapore

News & Resources

Company

Description

Key Data

Achates Power is developing high fuel-efficiency opposed-piston engines that aim to significantly reduce carbon dioxide, particulate and nitrogen oxide emissions.

Venture Capital - North America

Year Founded:

2004

CI invested:

2017

Leadership:

David Crompton, CEO

Location:

San Diego, California (US)

News & Resources

Company

Description

Key Data

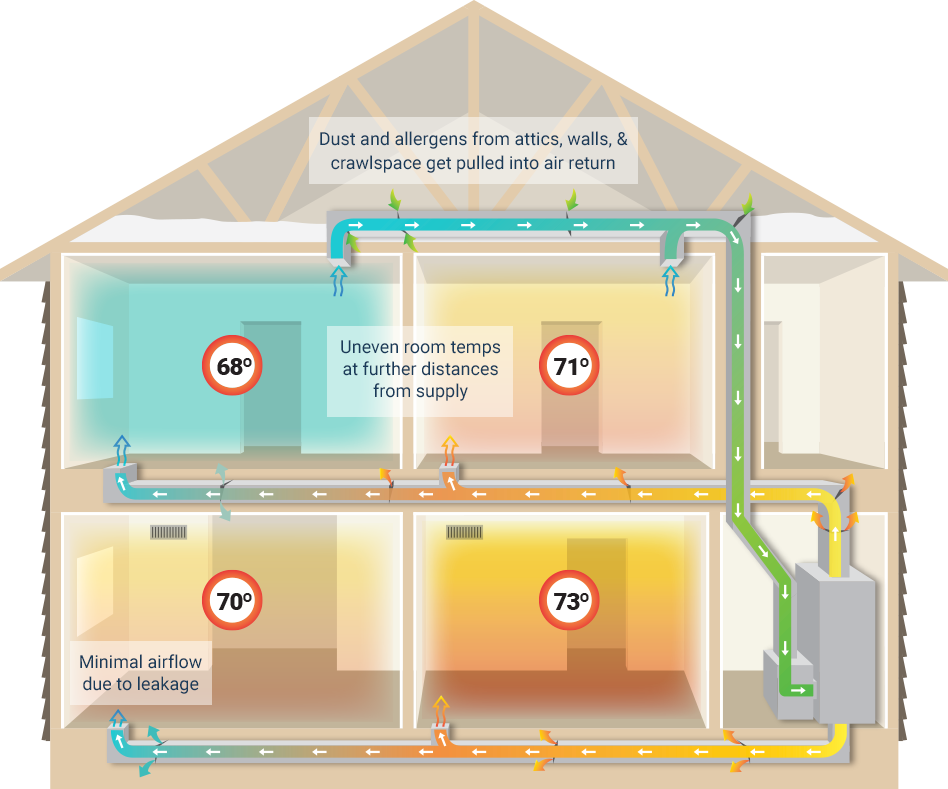

Aeroseal offers energy efficiency solutions that reduce building energy consumption by an average of 30% through sealing air leaks.

Venture Capital - North America, Middle East

Year Founded:

2020

CI invested:

2023

Leadership:

Amit Gupta, CEO

Location:

US, Saudi Arabia

News & Resources

Company

Description

Key Data

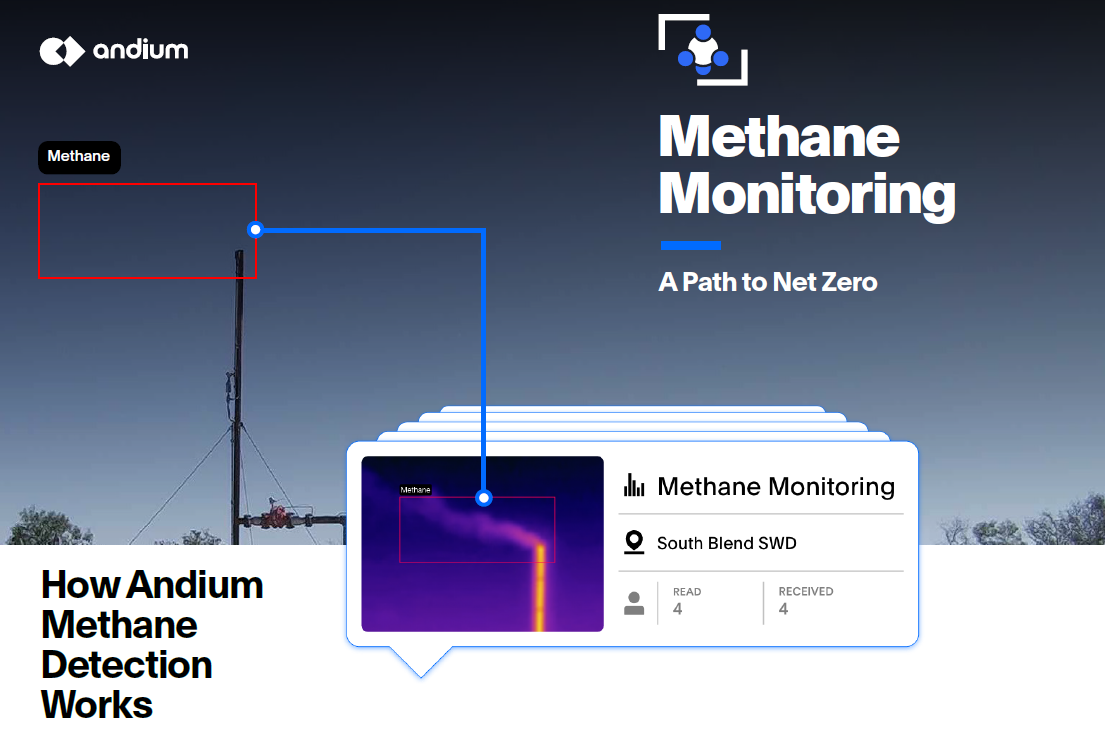

Andium provides remote on-the-ground monitoring activities. It monitors 24/7 and sends automated alerts for (1) methane release, (2) flare status, (3) tank levels and (4) detected objects like trucks, animals, people, liquid leaks and oil spills.

Venture Capital - North America

Year Founded:

2013

CI invested:

2021

Leadership:

Jory Schwach, Founder and CEO

Location:

New York

News & Resources

Company

Description

Key Data

Boston Metal’s MOE technology enhances metal production efficiency and sustainability by using renewable electricity to extract pure liquid iron and oxygen from iron ore, eliminating carbon use. It also produces critical metals from mining waste.

Venture Capital - North America, South America

Year Founded:

2013

CI invested:

2019

Leadership:

Tadeu Carneiro, Chairman and CEO

Location:

US, Brazil

News & Resources

Company

Description

Key Data

Carbon Upcycling captures CO2 from low-purity sources like flue gas and uses it to convert inert materials such as fly ash, steel slags, and clays into enhanced SCMs. This scalable technology offers a circular solution for CO2 and waste reduction.

Venture Capital - North America

Year Founded:

2014

CI invested:

2023

Leadership:

Apoorv Sinha, CEO

Location:

Canada, US and UK

News & Resources

Company

Description

Key Data

In partnership with AMPO POYAM, Clarke Valve designs and manufactures compact Dilating Disk Valves that offer precise control and zero fugitive emissions while meeting the highest industry standards.

Venture Capital - North America

Year Founded:

2011

CI invested:

2018

Leadership:

Kyle Daniels, President and CEO

Location:

Rhode Island, US

News & Resources

Portfolio commercialization

Having invested in a high-potential innovation, we then drive its market adoption through Climate Investment’s global network. Our engaged post-investment model is focused on accelerating market adoption and generating impact at scale.

We have a dedicated team of market acceleration specialists in our Commercialization Team who focus on driving financial and impact success in the following ways:

- Market research and deployment opportunity identification (high-potential opportunities identified to support portfolio companies’ business development)

- Actioning identified deployment opportunities (introductions, business development, knowledge sharing, deployment facilitation)

- Support for LP Deployment Champions whose role is to facilitate deployment opportunities within their firms’ operations

We have an in-depth understanding of how each portfolio company’s technologies and business models are differentiated relative to their competition. In combination with our knowledge of customer opportunity gaps, we can guide our innovators towards the most attractive and receptive target markets.

Decarbonization Success stories

These examples are portfolio companies in Catalyst Fund I, an unregulated and proprietary fund managed by CI.

These case studies were published on the dates shown in the original document to which the links have been provided above.

Portfolio company testimonials

* Throughout this website, Climate Investment and CI are used interchangeably.

Each testimonial was provided in the period 2022-2023 by a portfolio company in

Catalyst Fund I, an unregulated and proprietary fund managed by CI and is reproduced

with permission of each company. No portfolio company was compensated for

the testimonial provided, but potential conflicts of interest associated with

the statements made by portfolio companies may arise. The portfolio companies

are owned by funds managed by CI and may seek additional capital in the future.

Seeking capital?

Are you a company looking for investment? We actively encourage innovators to consider Climate Investment for potential investment. If you are raising early-stage through to early-growth capital, please get in touch. We’d love to hear from you.