Impact Report 2024

Foreword from CEO

The Climate Transition brings with it an enormous global opportunity.

The past years have ushered in a period of uncertainty and disruption in global markets and supply chains. History tells us that periods of disruption are also periods of great economic transformations where investors and risk capital have been front and center, helping drive new entrepreneurs to unseat incumbents. Fewer than 200 of the companies in the Fortune 500 from the Year 2000 are still in their seats today!

In 2025, we are straddling two transformations… the maturation of the Data Revolution and the beginning of the Climate Transition. And as with prior transformations, Mechanical Production (1885-1915), Mass Production (1939-1969), Information Technology (1984-2000), we will see a changing of the guard, not just in the “most valuable” companies but also in the countries and regions where these new leaders will arise.

As with prior revolutions, it is the innovators and the investors who recognize the future who will benefit the most from it. Many still overlook the unfolding Climate Transition and do not see that global warming is the cost of all prior revolutions. The Industrial and IT revolutions took us

from just over 5 gigatonnes (Gt) of annual GHG-emissions to more than 50 Gt per year, and the Data Revolution, at maturity, could add 10s of Gts of further emissions by 2050 – depending upon its trajectory. The emissions-driven warming will bring unprecedented changes, affecting

the availability of food, energy, water and services around the world.

Climate Investment is a firm focused on technologies that will shape the infrastructure of the future, and we believe that the most valuable of these will be driven by the Climate Transition. We see opportunities to deliver transformative technologies that leverage the learnings of the

past industrial, IT and data transformations to deliver lower-cost, higher-value and lower-emissions technologies to some of the world’s largest infrastructure companies. CI’s partnership with these companies provides us with unprecedented insight into the problems we need to solve, and access to the experts who need these solutions. Our ecosystem of global infrastructure partners, combined with a team of investors, entrepreneurs and operators, allows us to focus on the “hard to abate” white-space and unlock value in areas often overlooked.

This report provides insights into our portfolio, our business model, our partners who create opportunities with us, and our portfolio impact. I invite you to join with us.

Dr Pratima Rangarajan

CEO, Climate Investment

Climate Investment at a glance

0

Investments to date

0

Exits to date

0

Active portfolio companies

>10K

Climate deals screened to date

0

Deployments supported to date

29%

Increase in portfolio revenue in 2024

CI’s Portfolio Annual Impact

0

MtCO2e realized in 20241

Equivalent to the annual emissions of 30 500MW hyperscale data centres2

CI’s Portfolio Cumulative Impact

0

MtCO2e cumulatively since 20191

More than the annual CO2 emissions of Chile in 20233

Leading climate impact

Lorem ipsum dolor sit amet vel aenean vel non cursus tristique adipiscing vulputate. Malesuada elit quis vulputate blandit gravida orci risus suspendisse.

Name Last Name

Job Title

Responsible Investment Framework

CI is an impact investor guided by the UN’s Principles for Responsible Investment. We define impact as emissions abatement and integrate it into every stage of our investment process—from initial estimates to post-investment tracking with each portfolio company.

Impact Methodology

Since 2018, CI has built a robust GHG impact methodology to guide high-impact investments. We co-founded Project Frame in 2020 to help set industry standards.

We focus on two key metrics:

- Planned impact – forecasted future emissions abatement

- Realized impact – actual emissions reductions delivered

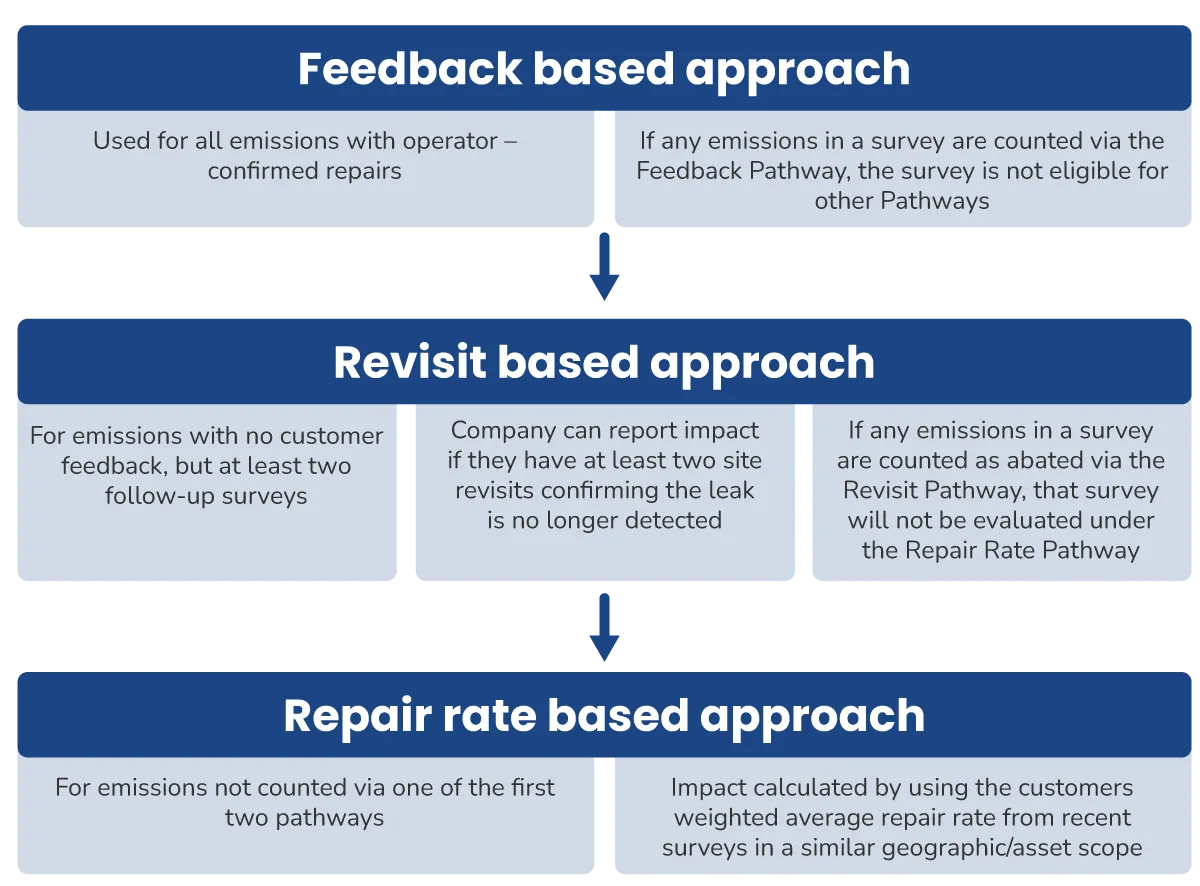

Impact is calculated by comparing life cycle emissions to a baseline and scaling by market units. Two-thirds of our investments deliver direct impact; the rest enable action through insights—like methane detection systems.

Download the report to learn more or visit our Impact page.

Reporting & Assurance

CI publishes its impact methodology annually, with limited assurance from EY to ISAE 3000 standards. Each year, we refine our approach based on third-party feedback to ensure it remains robust and relevant.

2024 Impact Report

Investment strategies

Our firm runs complementary venture capital and growth equity strategies supported by a common investment model which has been developed over the last eight years in partnership with global industrial leaders in decarbonization.

Our investment model is unique

- We have deep sector experience in house

- We partner with our industry investors to understand their problems and accelerate adoption through deployment in their operations

For our investors we believe this means we can delivers:

- Superior financial performance alongside outsized greenhouse gas impact

- Transformative technologies to enhance operations and enable growth

We invest where others don’t —backing bold solutions for the sectors that matter most to climate.

Josh Haacker

Chief Investment Officer, CI

Portfolio Geographic Expansion

CI has historically enabled global growth for our portfolio companies by facilitating introductions to overseas clients—such as Seekops, which expanded its drone-based methane surveying to OGCI companies across 25 countries. Of 247 deployments to date, 66 have been in non-OECD countries.

To drive more sustained expansion, we’re now supporting local partnerships. In 2023, Clarke Valve partnered with AMPO, fueling global growth. Aeroseal partnered with Aramco to enter Saudi Arabia and, in September 2024, acquired Advanced World Trading, rebranding as Aeroseal Arabia. We’re also supporting Saudi expansion for Andium and Converge.

Case studies

1 We report on the total realized impact of our portfolio investments, i.e. the sum of 100% share of the GHG reduction

delivered by each company in the Portfolio.

2 Using historical average load data (Data Center Load Forecasts, 2024 – 2040) and a global grid average carbon intensity

3 EDGAR – https://edgar.jrc.ec.europa.eu/report_2024#emissions_table

Beyond capital

We don’t just invest—we actively accelerate. For our investors, that means access to insights, deployment opportunities, and co-investment potential. For our portfolio companies, it means hands-on support, board-level guidance, and help bringing their solutions to market.

LP Engagement Framework

We’re proud to partner with 16 blue-chip investors leading their sectors. At CI, we go beyond capital—offering a hands-on engagement model that helps our Limited Partners learn, deploy, and co-invest in transformative climate tech.

Through knowledge sharing, portfolio deployment, and co-investment opportunities, each LP is supported by a dedicated account manager and year-round engagement.

It’s a partnership built to accelerate climate impact.

Supporting Portfolio Growth

CI’s Commercialization team plays a hands-on role in helping portfolio companies scale—connecting them with strategic partners, facilitating pilots, and accelerating adoption across sectors. In 2024, we enabled 83 new deployments—up nearly 60% from 2023—bringing our total to 247.

We’re expanding into transport and the built environment, while deepening ties with OGCI and the Oil and Gas Decarbonization Charter (OGDC) to unlock new opportunities.

It’s how our team turns potential into progress.

Climate Ecosystem Development

We work to unlock systemic change. Since inception, we’ve backed first-of-a-kind projects like Net Zero Teesside, advanced impact standards through Project Frame, and scaled methane solutions through SensorUp and ICA-Finance.

In 2024, we helped shape carbon credit standards and launched new methane initiatives in Iraq and beyond—directing capital where it’s needed most.

It’s how we help shape the system, not just the solution.

Sustainability at CI

In 2024, we reduced our firm emissions by 11% driven by a 428,000 km drop in air travel and introduced internal carbon pricing through AMEX to influence travel decisions. We also embedded supplier GHG checks into procurement workflows and offset our footprint using credits from our portoflio company, Qnergy.

Our financed emissions totalled 168 KtCO₂e, while our portfolio companies—employing 2,154 people, delivered 37.8 MtCO₂e in impact. ESG tracking now spans diversity, governance, and risk across the portfolio.

Want the full picture?

Download our 2024 Impact Report to explore our environmental, social, and governance performance in detail

Previous annual reports

Climate Investment grows GHG impact by 39% year-on-year

In 2023, our Catalyst portfolio achieved over 38 million tonnes (MT) of carbon dioxide equivalent reduction, a 39% increase year-on-year.

Climate Investment grows GHG impact by over 70% year-on-year

In 2022, our portfolio achieved over 27 million tonnes (MT) of CO2e reduction, marking our strongest year to date.

Climate Investment publishes its inaugural Impact Report covering GHG emissions

This is Climate Investment’s first Impact Report, and it covers the 23 investments made between the start of our operations in mid-2017 and the end of 2021.