From PID to Perception: The Evolution of Industrial Intelligence

11 September 2025

The evolution of industrial system control has always followed a simple mandate: improve stability, efficiency, and safety in complex systems. In the early days, this meant measuring and responding to physical changes- first through mechanical governors, later through analogue and digital feedback systems. As these systems matured, they became more sophisticated, giving rise to Proportional-Integral-Derivative (PID) loops and eventually to Model Predictive Control (MPC).

Industrial control systems have historically relied on numerical signals representing pressure, flow, and temperature to keep assets within operational bounds. These systems were robust, but narrow. They optimized around known variables, and they relied heavily on skilled operators to provide the missing context: smells, sounds, vibrations, and anomalies not captured in a Programmable Logic Controller (PLC).

That boundary is now dissolving. A new generation of autonomous systems is expanding the scope of industrial control, not only through automation, but also through perception.

From Control to Perception

Today’s industrial perception capability is expanding rapidly. Visual cameras, acoustic sensors, gas detectors, infrared imagers, and thermal arrays, some mounted to robots or drones, others fixed in place, are being combined with edge AI and cloud platforms to monitor complex industrial environments in real time. These systems can detect changes in asset behaviour, identify leaks or flares before thresholds are breached, and analyze operator notes for relevant patterns.

In short, the machines are no longer just executing tasks. They’re beginning to interpret context.

As we move on from fixed sensors, robotics introduce a significant layer of adaptability and autonomy. It enables sensors to be deployed not just in the most critical locations, but also at the most opportune times. Mobile robotic platforms can conduct inspections in remote, dynamic, or hazardous areas that fixed systems cannot access. This capability allows for targeted and flexible data collection that can be scaled across diverse environments.

This shift from actuation to awareness represents a fundamental change in the operation of critical infrastructure.

It’s not only about “smarter robots.” It’s about fusing sensory inputs (visual, auditory, numeric, linguistic) into systems that can reason, adapt, and intervene in real time.

At Climate Investment (CI), we recognize this as a pivotal moment and are investing accordingly.

The Industrial Readiness Gap

Consider the current landscape: More than 50% of grid infrastructure in developed economies is over 20 years old, creating increased demand for monitoring, inspections, and repairs at precisely the moment when labour shortages are most acute1. In oil and gas, more than half of technical professionals are aged 50 and above. Helicopter-based offshore inspections remain the standard practice, and manual leak detection still predominates in methane and SF₆ management. These are not isolated incidents; they represent systemic challenges that undermine performance, safety, and climate goals.

At the same time, there are shifting structural factors that are at play, particularly in hazardous environments and emissions disclosure requirements are becoming stricter. The price of lithium-ion battery packs has dropped significantly by approximately 90% from 2008 and 2023, decreasing from about $1,415/kWh to $139/kWh2. Additionally, advancements in AI and edge processing technologies now allow for detection, classification, and localization of anomalies without human intervention. All of these changes make autonomous inspection not just viable, but essential.

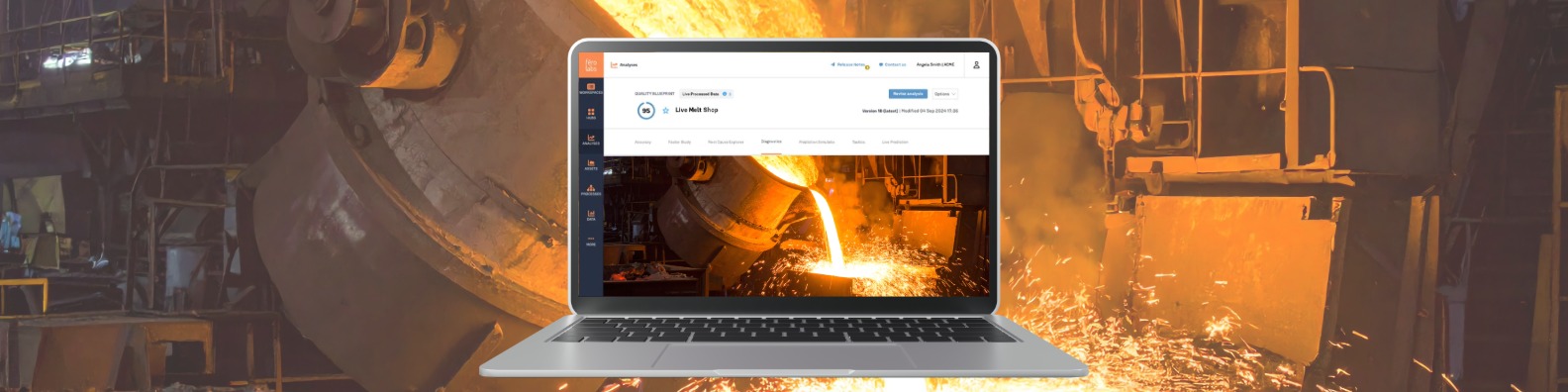

From Pilots to Platforms

The first wave of autonomous inspection was defined by fragmentation. Single-purpose systems, whether a drone, a sensor mast, or a quadruped, were frequently deployed in isolation to address specific problems. While they demonstrated potential, they functioned outside of core workflows.

What’s changing now is the architecture. Sensing, mobility, and analytics are being unified into integrated platforms that deliver continuous, contextualized awareness.

This shift isn’t about a single robot doing everything. It’s about orchestrated systems that combine stationary and mobile sensors, cloud and edge compute, and AI-enabled insight across time and space.

Value is shifting from devices to decisions—from toolkits to trusted infrastructure. As with industrial sensing overall, the winners will not be those with the flashiest hardware, but those who can translate signals into insights and insights into action.

Perception as a System Layer

What does “perception” look like in this context? It’s not just image recognition or audio classification. It’s a layered approach to awareness.

- Numeric Adaptation: Machine learning models that adjust in real time to changing load, demand, or environmental conditions.

- Visual Input: Identifying leaks, corrosion, misalignment, or thermal anomalies before they trigger alarms.

- Auditory Signals: Listening for bearing wear, valve malfunction, cavitation, or gas leaks through ultrasonic microphones.

- Language Understanding: Parsing operator logs, maintenance notes, plant manuals, and standard operating procedures to create structured insight.

- Mobility & Access: Using robotics to place sensors where and when they’re needed most—through autonomous navigation in confined spaces, hazardous zones, or areas without GPS or satellite positioning.

- Spatial-Temporal Fusion: Linking events across time and geography to detect degradation patterns or emerging risks.

- Convergent Control: Integrating sensing, movement, reasoning, and actuation into a loop that’s adaptive, not reactive.

In the past, these functions were siloed. Today, they are converging through new software layers that integrate sensing, mobility, perception, and control. Robotics provides the mobility and access; the software orchestrates them into adaptive, system-level intelligence.

The CI Lens: Why We’re Investing Here

At CI, we’re not focused on robotics in isolation. We invest in the full architecture of industrial awareness, looking at systems that combine sensing, data, autonomy, and software orchestration to improve outcomes across emissions, safety, and uptime.

Autonomous inspection can directly reduce emissions, including methane, VOCs, and SF₆ leaks that would otherwise go undetected, as well as downtime that stalls renewables or triggers flaring, and safety protocols that rely on helicopters or manual rounds in hazardous zones. They also can reduce exposure of staff to dangerous or toxic environments.

But it’s not enough to make sense. It must scale. That’s why our thesis is focused on:

- Enterprise-grade platforms that meet cybersecurity, integration, and regulatory standards

- Interoperable systems that can integrate across tools, teams, and asset types—whether built around proprietary hardware or modular fleets

- Proven ROI through reduced downtime, cost savings, and higher asset availability

- Operational intelligence, not just automation—systems that learn, adapt, and inform

We are backing the development of a framework for coordinated autonomy, as the future of industrial intelligence will go beyond mere monitoring and automation to include the ability to perceive, make decisions, and take action.

In the weeks ahead, we’ll share more about how we’re putting this thesis into action. But the direction is clear.

1IEA, “Electricity Grids and Secure Energy Transitions,” 2023, p. 27.

2The DOE’s Vehicle Technologies, Battery Tech Online; Carscoops also reports: “From $1,415/kWh in 2008 to $139/kWh in 2023” (Carscoops)